The market goes up and the market goes down. This is a fact as inexorable as the sun rising and setting and waves forming on the sea. Yet so many are unprepared to run a business during a recession.

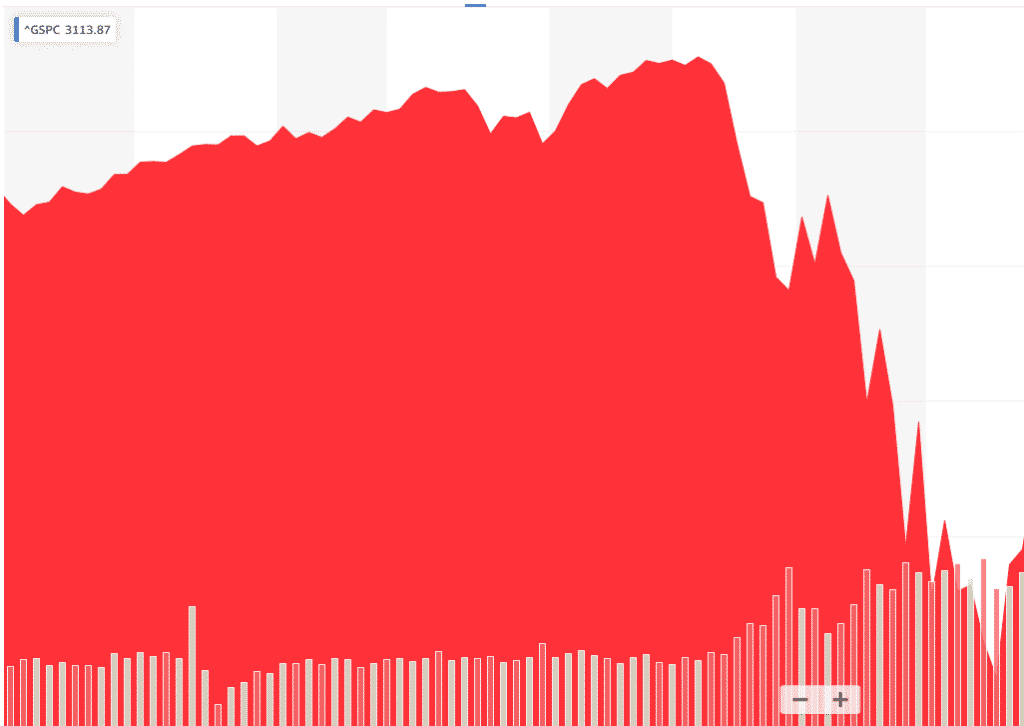

Fulfillrite was born in 2009, right in the heart of what was at that point the worst economic downturn since the Great Depression. It’s too soon to tell now, but we have every reason to believe that the coronavirus recession will be worse. Yet business must go on. Life must continue as normally as safely possible.

A lot of business owners are thinking about business continuity right now. They ask “how do I keep going when the going is tough?” Some are hurriedly breaking into eCommerce while others are coming up with recession-proof products.

1. Recognize that you have power, but not unlimited power, to fix problems as they arise.

One of the most important things to realize when running a business during a recession is that the problem is much bigger than you. Many of the troubles your business will experience are not the direct result of poor leadership. A good deal of what you will encounter will be outside of your direct control.

Even with that said, remember that humanity at large is resilient, resourceful, and creative. That means you, too. You, and by extension, your business can adapt to the changing business climate. In order to do that, though, you must be able to clearly understand what is within your ability to control and what is not.

2. Assess the health of your business.

Recessions provide excellent opportunities to slow down and assess the overall health of your business. It is easy, in the heat of day-to-day operations, to forget about basic business well-being. In particular, if you find yourself in the middle of a recession, like this one, it’s a good time to ask yourself these four questions:

- Do we have sufficient cash on hand to survive an extended period of reduced revenue?

- At the present time, do we have all the capital we need to operate indefinitely without further investment?

- Are our revenues steady and sufficient for a long-lasting business?

- How engaged is the workforce?

If the answers to any of these four questions alarm you, then focus on fixing the underlying problems.

3. Cut pointless expenses fast.

When business is going well, it often means being really busy. Sometimes, this manifests itself as being too busy to pinch every penny and evaluate every expense. It’s only natural, considering how even the most frugal people have a limited capacity for making decisions to save money when slammed with work.

Recessions often mean losing work. This can be devastating, but the upside is that you gain time. This newfound time can be put to work by cutting the kind of petty expenses that quickly add up during the good times.

4. Reset your expectations.

Whenever a massive global event, such as a sharp economic downturn, occurs, it’s a good time to reevaluate your goals. What you thought was possible as recently as January may not be possible now. Adjust your expectations so that you can commit to achieving realistic goals that factor in recent changes.

5. Take care of your employees.

Recessions that are hard on small business owners are often devastating for individual employees. With the coronavirus recession, in particular, the lowest-earning workers have suffered noticeably more. As much as you are able, lend a helping hand to your employees.

First, use your employee assistance program. Programs like this can do wonders for employees’ mental health. A lot of people can benefit from a non-judgmental helping hand.

For others, find ways to make work better without spending more money. Allow workers to work more flexibly. Find ways to make the office more comfortable.

6. Make sure you have good cash flow.

In times when the economy is unstable, cash is king. Revenues need to exceed expenses if at all possible. Obviously, your business will need to keep as much money flowing is as possible.

Bear in mind that excessive cost-cutting can hamper your business’s ability to compete. After cutting obvious wastes of money, your instinct should be to increase revenues instead of cut expenses in order to maintain good cash flow.

7. Audit your supply chain for waste.

If you sell physical products, one of the most important parts of your business is the supply chain. Being able to create and move physical goods will determine your success.

Unfortunately, maintaining the supply chain is expensive. This is partly because of how complex it is. You have to be able to adequately plan for demand, manufacture products, transport those products, warehouse them, fulfill orders, and manage returns. All this has to be done while maintaining a good customer experience too.

It’s a good idea to audit your supply chain during times of economic distress to see if you can make it more efficient. A smoothly operating supply chain, particularly during difficult times, can be a competitive advantage for your business.

Of all the functions in the supply chain, we find that demand planning and warehousing/fulfillment are the ones that leave the most room for error. While demand planning has to take into account factors unique to each business, warehousing/fulfillment is pretty standardized. That’s why a lot of companies choose to outsource warehousing and fulfillment to companies like Fulfillrite.

8. Focus on what you do well.

Corporate conglomerates do well because they have a diverse array of businesses in a diverse array of industries. Small businesses cannot do that. It’s dangerous to try to focus on too many things at once, especially during a recession.

When the market takes a turn for the worse, take a moment to analyze what your company does well and what is profitable. Cut out anything that is not a core competency of your business.

9. Upsell to existing clients.

Acquiring new customers is already harder than maintaining existing client relationships. This is especially true when the economy is doing poorly. That’s why one of the best ways to shore up revenues is to reach out to put who are already buying from you or using your services to see if they need more.

10. Don’t cut marketing.

As tempting as it may be to cut marketing expenses during a recession, to do so would be a mistake. The reasons for this are twofold.

First, because businesses need to maintain steady cash flows, they need a way to generate leads. Marketing is the primary vehicle through which leads are generated, and when its budget is cut, it becomes much harder to sustain the revenues necessary to survive.

Second, all recessions come to an end eventually. Businesses that invest in, or simply maintain, marketing budgets during recessions often end up gaining market share in the process. Likewise, companies that cut back their marketing expenses during a recession often miss out on a golden opportunity to grow.

Final Thoughts on Running a Business During a Recession

Running a business during a recession is not easy, but it is doable. Recessions provide opportunities for businesses to stop and analyze what is working and what is not. With that frame of mind, it becomes much easier to proceed. Then all you have to do is keep revenues rolling in and workers happy.

No. Businesses need to maintain steady cash flows but must have leads generated to do so. Marketing is the primary vehicle to generate leads. Additionally, recessions come to an end eventually, so investing and maintaining a marketing budget during a recession gain market share by the end of the recession.